Lenders provides additional minimum and you can maximum amounts having credit a personal financing https://availableloan.net/installment-loans-tx/fresno/. Unsecured loans for $2 hundred,000 have become uncommon. If you discover a lender that gives a six-figure unsecured loan, it’s usually capped at the $100,000. Normally, lenders cap the quantity you might use which have you to definitely consumer loan at $40,000 otherwise $fifty,000. Yet not, there are ways you can probably get financing having $200,000 playing with almost every other mortgage situations. Learn more about the options for credit considerable amounts of cash.

Secret Takeaways

- Signature loans to have $200,000 have become unusual, however some lenders offer $100,000 maximums.

- Many lenders cap their limitation amount borrowed from the $40,000 or $fifty,000.

- The higher your credit rating, the greater the probability of being qualified to own an effective $100,000 consumer loan, but people who have less than perfect credit still may accepted.

- If you aren’t qualified to receive a massive personal loan, go for several quicker unsecured loans otherwise score a beneficial co-signer so you can be considered.

- If you have enough domestic guarantee, you will get a home equity mortgage or credit line to possess $200,000.

The way to get a massive Consumer loan

Although you could get an excellent $2 hundred,000 home loan or home mortgage refinance loan, you would not most likely come across a personal loan for this amount. Instead of mortgage brokers, signature loans are usually unsecured, definition they may not be supported by collateral. Signature loans is a top exposure getting loan providers, very these are typically usually reluctant to provide up to they manage getting a secured mortgage.

Overall, the greater money we need to use, the better the creditworthiness needs to be. You want a robust credit history and enough income. Here are the chief steps simply take to acquire a giant consumer loan.

step one. Look at your Credit score

The higher your credit rating, a lot more likely loan providers should be agree your for the mortgage amount your demand (as much as the restriction restrict). Sophisticated borrowing from the bank tells loan providers you happen to be in charge which have borrowing much less more than likely to help you default on the a loan.

2pare Lenders

Evaluate loan providers based on things including the restrict amount borrowed it provide, cost terms, rates of interest, and you can any charges they could fees. If you need a great $2 hundred,000 mortgage, make sure to can afford to make the monthly obligations. Financing with down interest levels and you can lengthened repayment words imply lower monthly premiums.

You could examine finance out of some other lenders using pre-qualification. This involves a soft credit check and you may does not harm your own borrowing from the bank score.

step 3. Assemble Documents

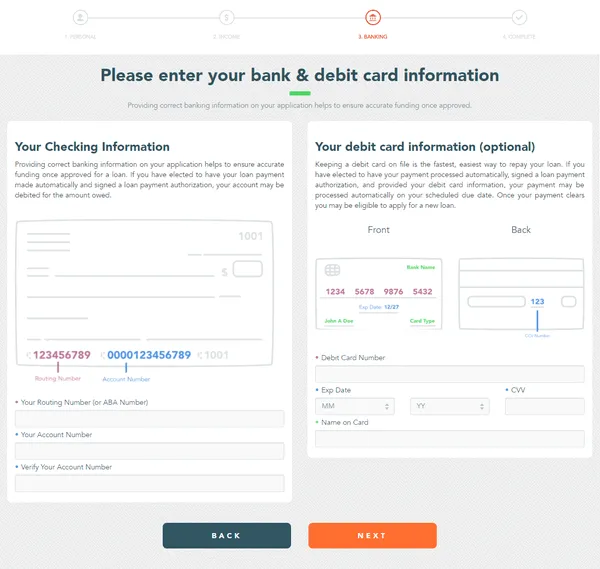

Once you have obtained pre-accredited that have a loan provider whoever funds do the job, prepare yourself the newest files you will need to done a full software. These may were a copy of the driver’s license and other government-awarded personality, your Social Protection count (SSN), evidence of target, and you may a career confirmation, one of most other records.

You will also most likely need secret monetary data files, eg bank statements, tax statements, W-2s, and spend stubs, to confirm your income and you feel the means to pay-off your loan.

cuatro. Implement

Really personal bank loan lenders enable you to implement online, and you may discover immediately if you are accepted. Once you implement and have now recognized, you could potentially accept financing conditions and set up banking guidance.

All of the disbursement day is different, with regards to the lender, but in many cases, you can generally speaking located the money in as little as 1 day otherwise up to weekly.

Where you might get Large Signature loans

- LightStream: LightStream even offers money doing $100,000 and you will enough time installment terminology, up to a dozen ages. LightStream’s money are often for borrowers having an excellent otherwise excellent credit and feature a much bigger-than-mediocre autopay disregard without charge.

Нет Ответов