Owning a home or an article of home is a significant fantasy for most Filipinos. I am aware it is personally. You www.availableloan.net/installment-loans-ak/central/ will find constantly wished to features a place to label my, where I am able to improve a family group and build memory that can past an existence.

One of the most preferred strategies is actually financial resource. This article will require your step-by-action from the procedure for providing a home loan off good bank regarding the Philippines.

step 1. Dictate Your finances

The initial step to buying a home is always to determine your own finances. This should help you restrict your pursuit and avoid overspending.

Really financial institutions regarding Philippines will financing around 80% of your property’s appraised value. Because of this make an effort to come up with on minimum 20% of cost just like the a down-payment.

Along with the downpayment, additionally, you will have to reason for new month-to-month amortizations. The newest amortizations is the monthly premiums you’ll create to the bank to settle the mortgage. We recommend that your monthly amortizations should not meet or exceed 30-40% of your own monthly income.

2. Start Your residence Hunting Travels

Once you’ve determined your financial budget, it’s time to begin your residence-bing search trip. There are some various ways to begin which:

- Work at a realtor. A realtor helps you see functions that see your circumstances and budget. Capable and discuss in your stead and you will assist you through the fresh new to purchase processes.

- Search for postings on the internet. Several websites listing properties available in the new Philippines. This might be a great way to rating an overview of the sector to check out what’s available.

- Visit developer strategies. When you find yourself interested in buying an effective pre-construction property, you can check out creator programs. This is a good way to see the floors agreements and services before they might be mainly based.

3. Set-aside a home

After you’ve receive the ideal possessions, it’s time to set aside they. This can make sure the house is maybe not sold in order to people more before you could have the opportunity to purchase it.

The fresh new scheduling techniques normally pertains to investing a scheduling payment. The level of this new reservation commission are different according to the creator otherwise merchant. Yet not, its generally speaking doing 2% of one’s cost.

Once you have paid this new booking fee, you will be offered a booking contract. This arrangement often outline new terms of this new reservation, such as the duration of the brand new booking months additionally the number of one’s put.

The brand new booking months is generally 30 days. During this time period, you’ll encounter the chance to carry out due diligence with the possessions and obtain investment. If you choose to buy the assets, the fresh booking fee will be paid to your this new deposit.

4. Collect the required Records to have home financing

The particular records necessary for a home loan regarding the Philippines can vary out-of financial to help you lender. not, very finance companies will demand the second:

- Appropriate government-granted IDs for everyone individuals, like a great passport, license, otherwise Federal ID credit.

- Evidence of money, like payslips, tax output, otherwise organization economic statements.

- Certification out-of a career (if appropriate).

- Business data files (having care about-operating otherwise business owners).

- Relationship offer (if the relevant).

- Tax Personality Number (TIN) and you will TIN ID.

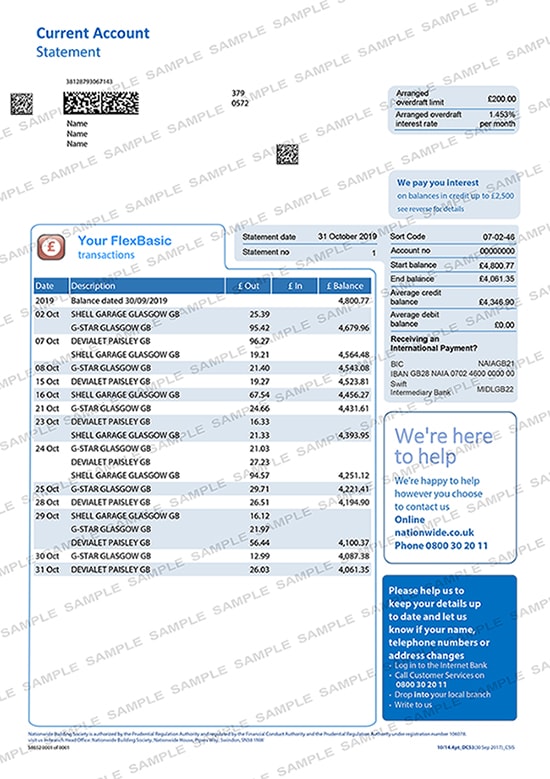

- Proof battery charging, such as a utility costs otherwise credit card statement.

It is very important gather all of these data files just that one can, once the financial might require them to process your loan software. You’ll be able to ask the financial institution having a summary of the specific documents needed.

Нет Ответов