Revelation declaration

Stuart Snaith doesn’t work having, request, individual shares from inside the or receive financial support regarding any business otherwise organisation that would benefit from this short article, and has unveiled zero related associations beyond its academic conference.

People

From inside the a quote to deal with Canada’s houses drama, Deputy Perfect Minister and you may Financing Minister Chrystia Freeland launched the brand new changes to help you financial legislation to your Sept. 16, set to start working from inside the December, intended for and also make houses economical.

The first significant alter are an increase in the purchase price limit to possess covered mortgages, increasing they to help you $step 1.5 billion of $1 million.

In the Canada, if the potential home buyers reduce than simply a 20 per cent deposit, he is required to possess default insurance rates. Home loan insurance rates covers lenders facing standard and assists people get house that have as little as five % deposit. Before statement, insurance coverage only has started readily available for residential property coming in at $one million or reduced.

The next alter ‘s the extension regarding amortization symptoms. Up to this present year, buyers just who called for default insurance coverage on the mortgage loans was indeed restricted to a 25-season amortization months.

Inside August, this was informal to allow first-go out people to get recently situated property which have a 30-12 months amortization. It has got now been expanded to allow very first-date customers to find any house. In addition, someone attempting to buy a different sort of make are now able to make the most of a 30-year financial.

Freeland advised reporters the alterations often place the dream about home ownership within the take a lot more young Canadians. But how likely is this type of changes and come up with home ownership so much more achievable getting Canadians who even more find it since a distant fantasy?

Drawbacks to remember

For every single section of that it announcement will increase buyers’ power to pick a property. Even more customers will be able to availableness 30-year mortgages, and that happens hand-in-give with lower mortgage repayments. Concurrently, more of the Canadian construction inventory could well be in the rate cover getting covered mortgage loans.

not, even with these alter, value stays difficulty. In the example of the increased rates cover, Canadians still need to be able to spend the money for financial when you look at the the initial place. Because the few Canadians can afford home financing of over an effective mil bucks, the newest perception of your own 29-season mortgages are the greater significant of one’s several strategies.

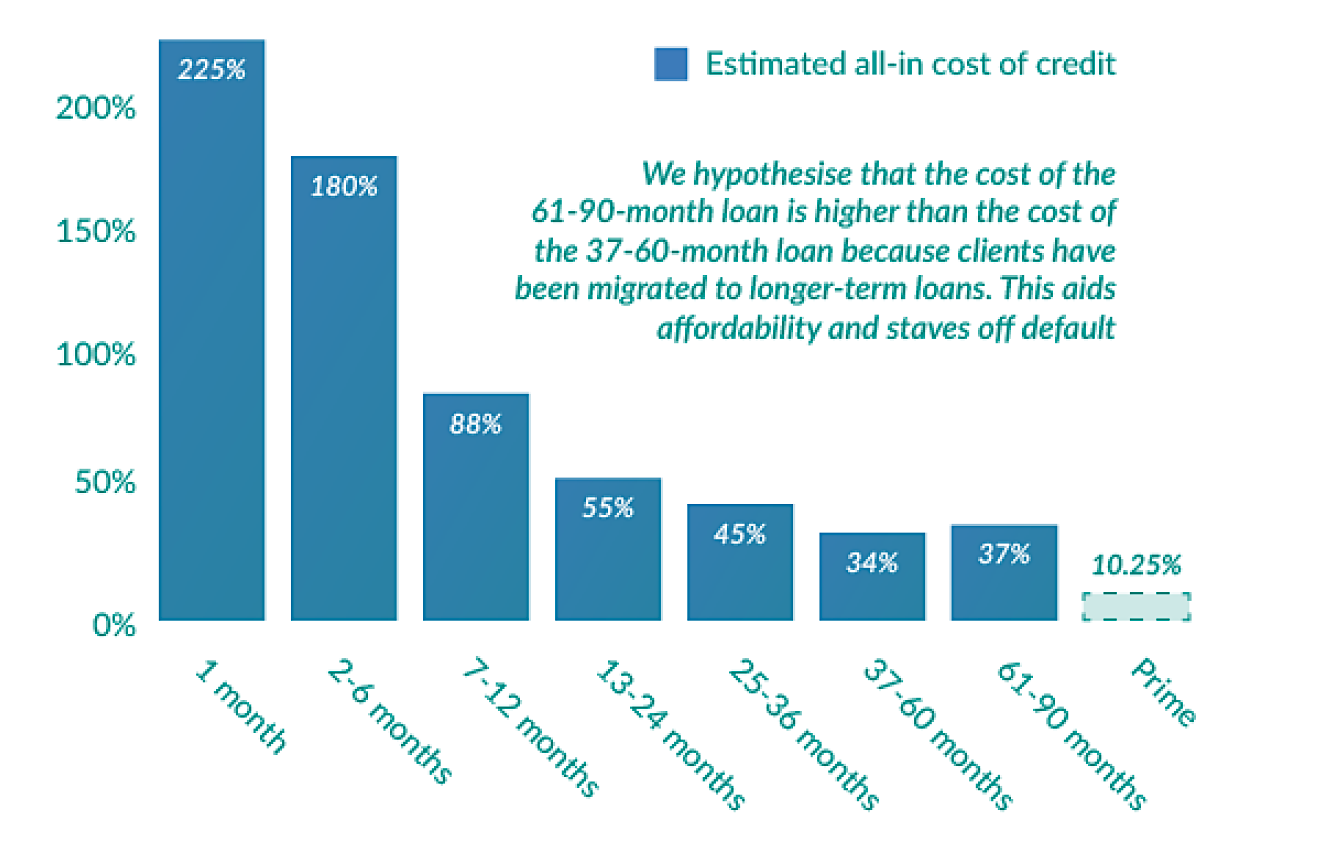

In the example of 29-season mortgage loans, when you are payments was smaller, a whole lot more attention might be paid off over the life of the mortgage. Think a loan out of $700,000. With a twenty-five-12 months home loan in the five %, brand new month-to-month home loan prices would be $cuatro,071 (disregarding the cost of bad credit loans in Hudson,CO standard insurance policies). With a 30-12 months financial on the same basis, which falls so you can $step 3,736. Yet not, additionally, it includes an estimated 24 percent upsurge in desire paid down across the life of the loan.

Another essential factor to consider is the fact Canada already comes with the higher home obligations to help you disposable earnings regarding the G7. Where does the majority of it financial obligation are from? Mortgage loans.

A beneficial 2023 statement from the Canada Home loan and you can Housing Organization receive you to 75 % off Canada’s house loans originates from mortgages. This type of highest degrees of loans can also be cause high destroy while in the times from economic crisis.

Obviously, large mortgages means a great deal more obligations. Since the fresh mortgage rules are designed to promote customers a lot more flexibility, the fresh new a lot of time-title feeling out-of big finance to your domestic loans therefore the large economy remains to be seen.

4 million property of the 2031

If you are such the new change is to turn on request, especially for the-produces, Freeland thinks new demand such strategies generate usually incentivize significantly more the new property construction and you will tackle the brand new property scarcity. Such change are part of the newest government’s jobs to get to know the goal of building almost five mil this new homes of the 2031.

Brand new government’s ability to ensure this type of brand new home manufactured commonly end up being the answer to guaranteeing such the home loan guidelines send to their pledge of making casing economical.

Regarding lack of improved also provide, the chance was this type of change could result in large prices, particularly because Bank out of Canada continues to slashed rates of interest and you will given this month Canada’s inflation price ultimately smack the Financial out-of Canada’s address. Actually a current report because of the Desjardins cautions that enhancing the duration out of mortgages you will worsen value.

Over the second couple household, this new interplay between rates falls, the newest home loan regulations and differing federal initiatives to deal with housing also have will need to be spotted directly. While making issues way more fascinating, the potential for a young election can lead to an alternative way of construction value given recent polling recommending Pierre Poilievre’s Old-fashioned Cluster you can expect to probably means another vast majority bodies.

Нет Ответов