When you submit an application form in order to a loan provider or a lending company, a painful credit score assessment is completed before last acceptance. Tough enquiries get off a footprint on the report and you will bring down your score peak because of the a few circumstances.

Numerous borrowing checks inside a short while physical stature may somewhat down your credit rating. Space your loan application never to harm your credit rating. Continue a screen out of fourteen so you can 200 loan no credit check direct lender forty-five weeks when you find yourself trying to get loans.

dos. After you pay off your debt

Using the money you owe on time and also in complete is the most the most common a method to generate the financing score. Their get usually gradually raise once you begin purchasing your mortgage punctually. If you have a bad credit get, you can easily boost it when you’re a responsible debtor.

Nonetheless it could impression your score if you don’t build regular costs. You’ll be able to find a decline on your own rating since lenders upload a report of your installment behaviour so you can Borrowing from the bank Site Businesses (CRAs) whom estimate your credit score.

Once you totally pay off the brand new financing which you have taken over to re-finance your loan the borrowed funds levels might possibly be signed. This type of profile could possibly get remain on your credit score so long given that 10 years. The credit rating might go down when such closed levels was dropped out-of the declaration. The size of your credit score will get drop-off whenever signed accounts is actually shelved.

Tips re-finance a financing?

This approach can save you currency for people who get a straight down rate of interest to the a special mortgage. There might be almost every other issues also where it’s wise to help you re-finance a personal loan.

1. Determine the quantity you prefer

In advance seeking financing estimates to help you re-finance your very own financing, figure out the genuine count you need to pay your existing financing. You could contact your bank who’ll direct you towards deciding the exact shape you require the most.

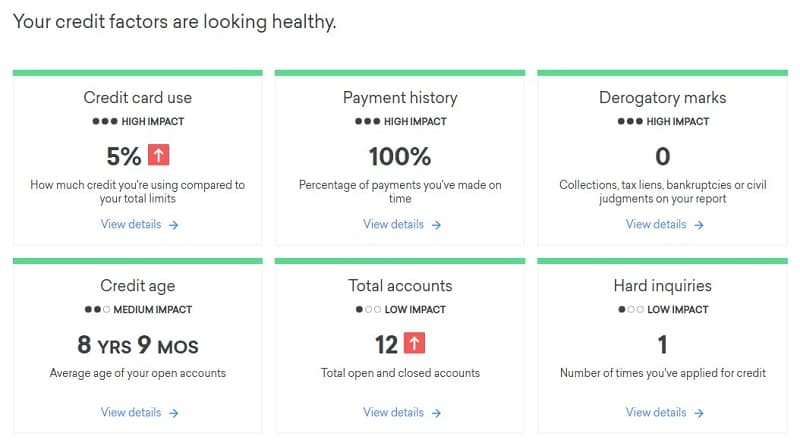

2. Look at the borrowing from the bank

Check your credit history which means you know where you stand. For those who have a high credit rating, youre very likely to come across that loan that have reduced-interest levels. But if your scores are not eg a great, you need to earliest work at boosting it prior to considering the choice from refinancing. Lower fico scores are often mean high-rates. Ergo, begin working on your own credit ratings.

step 3. Research rates to own lenders

Start contrasting mortgage also provides out of several loan providers. Make sure to was deciding on loan providers just who work with a silky register the first phase to provide financing estimates. Mellow monitors do not perception your credit rating.

Ready yourself a listing of every one of these lenders just who see your own standards. Just, restrict record by going right on through their lending requirements. Understand what those people loan providers you want regarding profiles of the individuals and look whether or not you easily fit into.

cuatro. See the will set you back inside it

The financial institution may charge you a young cost percentage, or an origination fee, that’ll impact the cost of repayment. Go through the Terms and conditions & Criteria offered by the financial institution with the this new mortgage and discuss they along with your financial.

These costs can increase the entire cost of credit about long run, so consider the fresh new regards to your existing financing as well. Read the financing contract cautiously before you could proceed to to remain the newest dotted line.

5. Seek pre-certification and implement

Pre-qualification form a laid-back research of one’s character before a cards look at is conducted on the declaration. You can acquire to understand whether you are qualified to receive taking aside a consumer loan in order to re-finance in the place of actually submission financing software.

Нет Ответов