Individual financing can be found to own industrial possessions; but not, this type of loan is not always a viable choice for periods longer than 12 24 months.Business charges with the private fund usually are 1-2% of your amount borrowed, and you can interest levels consist of high so you can very high (as much as dos 3% monthly).Personal fund could are capitalisation of the appeal costs, definition you aren’t needed to pay the focus up until the financing was paid back.The benefit of these kind of mortgage is they is going to be acknowledged and you will funded as quickly as 2-five days, and acceptance procedure is focused more on are present method instead compared to capability to services the debt.

- Brief bridging money, including where continues of a home profit was made use of to spend the personal mortgage, or a buy should be finished but lender loans is actually not yet in a position.

- Structure financing, where a website was created immediately after which sold, with marketing proceeds used to settle the borrowed funds.

- Home banking, in which the borrower plans to resorts a reports Application (DA) getting recognition after which sell the house towards recognized Da.

- Where the debtor will be getting fund subsequently but requires use of that cash now.

Almost every other procedures

All of the industrial house is ordered thru a combination of possibly equity, debt, otherwise each other.There are a selection of complex alternatives offered to and acquire a great industrial assets the place you do not have the element or perhaps the intention to accomplish the order on your own.

Selection include:

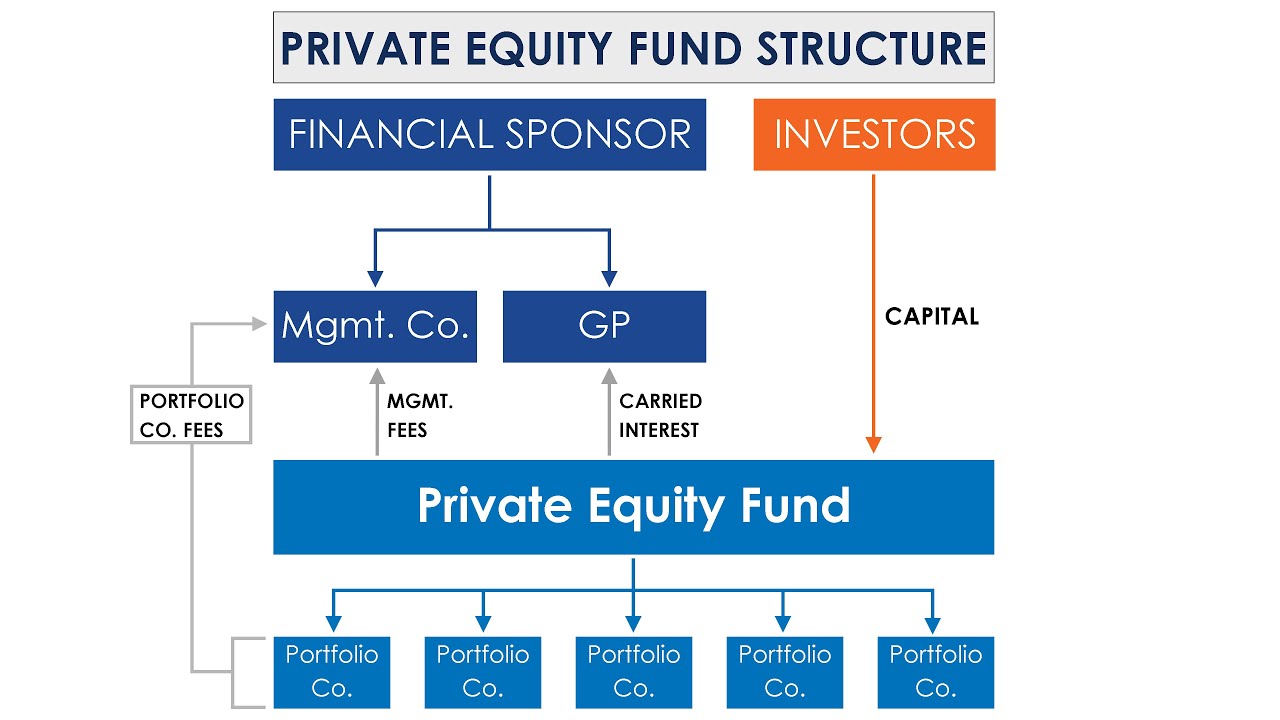

Mezzanine money involve a mixture of personal debt finance (loans) and you will guarantee financing, the spot where the guarantee investors have the choice adjust their guarantee so you’re able to financial obligation. So it ranks them just before almost every other people into personal loan Chicago the come back regarding its investment.Shared possibilities this calls for integrating having a new group who contributes electricity with the transaction. This can be using extra bucks for the buy, improving the capacity to borrow funds, otherwise offering experience/expertise.Individual security that is where individual dealers, otherwise individual financing fund, hold security on property and/or organization and this possess it.Real estate investment Trusts (REITs) allows you to put money into a house possessions via a confidence which has the brand new assets and you can entitles you to definitely show from the money those individuals possessions create. There are many REITs on the ASX, as well as allow it to be accessibility a selection of possessions property versus being forced to features a large amount of currency to pay otherwise the necessity to really deal with debt.Bell Partners Funds dont provide properties or advice on the brand new a lot more than, not we can part you toward the Monetary Thought and you can Money Manufacturing organization who will bring their information and you will services.

Handling Chance

As with any money, you’ll find a range of threats a part of commercial property. You need to choose expert advice when considering planning a great want to create such threats.

Dangers can include:

Interest exposure: Here is the exposure that welfare prices may differ unfavourably.Borrowing from the bank risk: Is the likelihood of losings when the contractual debt and you will covenants are perhaps not found otherwise costs aren’t generated.Business exposure: This might through the value of commercial assets had falling inside really worth otherwise a slipping local rental sector.Liquidity exposure: Describes the ability to convert the home to bucks via a sale or to availability the mandatory funds to meet ongoing personal debt for example financing money or other outgoings.

We have ages of experience in a broad variety of commercial property deals and you may use of an intensive panel out of lenders along with big finance companies, tier dos financial institutions, non-finance companies, separate loan providers, professional lenders, and private fund.We can assistance to:

Нет Ответов