Permitting consumers as you reach the monetary requirements is perhaps all i carry out, that is the reason we have been arming your with your professional understanding, information, and information to help you get indeed there.

- Mortgage Issues

- Real estate Possibilities

- Lives & Home

- Refinance Selection

- APM Insider

What to expect Whenever Providing a construction Mortgage

Strengthening an alternative household paydayloanalabama.com/greenville can lead to a ton of questions-you’re mulling more than sets from selecting a builder and you will searching for a spot to selecting the certain enjoys need. That is to state nothing of one’s house’s capital. In place of a preexisting house with a long-term home loan, strengthening a property normally demands a house build financing-at the very least in design phase. Luckily for us, all of our design credit party has actually your protected! We have sleek the development financial techniques so you know exactly what you’ll end up referring to.

Step 1: Apply for financing (Throughout the 20 minutes)

Similar to a long-term home loan, you’ll want to incorporate and you may qualify for a home build loan having one of our mortgage officials. You’ll be able to submit an application since you perform with a vintage mortgage.

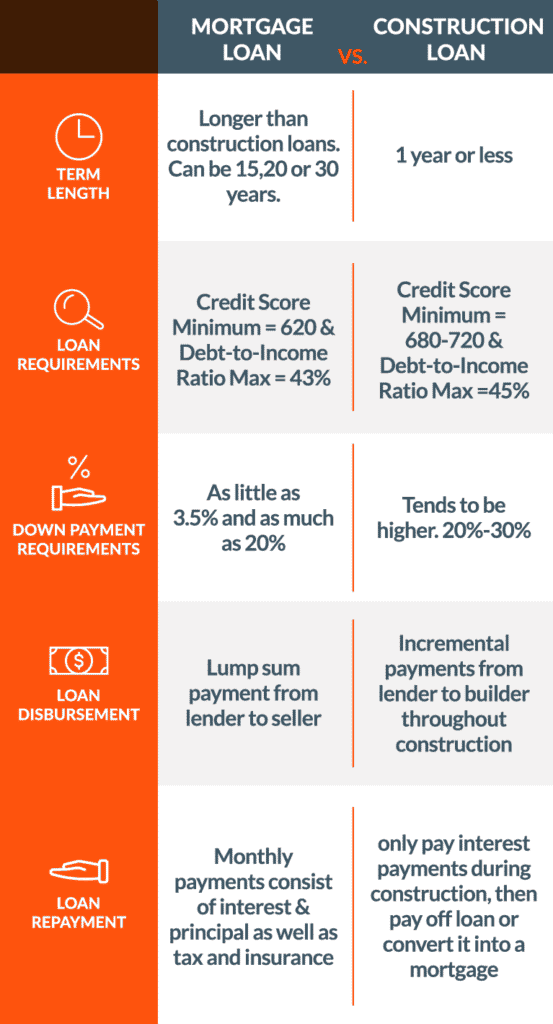

Some of the financing certificates will be based on the types of out-of permanent home loan you intend to track down, thus we are going to definitely qualify for both loans on beginning. Loan providers will typically review their down payment, credit rating, and you may earnings inside the home build application for the loan procedure.

The loan officer will require data files, pull your borrowing, and you can talk about debt certificates before speaking to your in the the brand new nitty-gritty regarding money-namely, the choices to your design loan, also rate, payment, and you can closing costs, also options for a long-term mortgage since design phase is complete.

A little while from the this type of financing …

APM uses what is actually called a good two-date closing for house construction loan. It means you’ll be able to be eligible for the original framework loan immediately after which once again towards long lasting financial (aka the very last loan) immediately after structure is done.

In the event qualifying double may sound tiresome, you do not have to be concerned about even more difficulties regarding the mortgage process whenever trying to get one another financing. Most people find the procedure is not that distinctive from qualifying for a classic home loan when selecting a preexisting household. And we will make sure you take you step-by-step through any extra criteria that will have to do with your unique webpages.

The original mortgage (the construction financing) persists merely when you are your home is throughout the design phase. It is possible to pay only notice on that financing, so there is actually multiple a way to manage the latest costs, including strengthening her or him to the mortgage alone. Immediately following construction is complete and you’re ready to move around in, it loan is replaced with a permanent mortgage.

There are many solutions that have a long-term home loan, hence our company is ready to go over with you each other on start of procedure and you may once again when it’s time for you to place you to definitely final portion positioned. This way not only can you plan for the future, as well as manage the present day business toward what’s readily available. It is vital to keep in mind that, in lieu of a home build mortgage, the newest permanent financial means you to make monthly obligations for the each other the interest additionally the dominating.

2: Earn some Conclusion (normally Time since you need)

The following is the spot where the brain kicks with the overdrive. When you make an application for your framework financing, you will need to nail down the selection of a builder or general specialist, the fresh home’s structure, as well as your lot. Just how on it you are in this action may vary based whether you’re to shop for a spec semi-custom home or if you will be building a totally bespoke home off abrasion.

Нет Ответов