Loan officers are built-in to the financial procedure. But exactly how far are you willing to secure? Is what you should be aware of loan administrator wages

- Can home loan officials make good money?

- Exactly what do the top mortgage officers generate?

- Will be a mortgage officer a demanding work?

- Can home mortgage officials make 6 data?

Mortgage loan officers let prospective homeowners select the right mortgage solution because of their finances. It is an advisable industry if you like enabling people-and it may feel probably lucrative.

Before you take you to definitely next step on your occupation, you will need to know very well what you’re getting yourself to the. Exactly how much can be mortgage loan officials generate? Is-it a tense work? What are the every single day employment you may be required to would? In this post, we’ll address such concerns plus. Is all you need to learn about an interest rate manager income.

Can mortgage officials create good money?

The new small answer is, sure, home mortgage officials can make good money-typically between around $70,000 so you’re able to $ninety,000 a-year, an average of. But not, just like the a top earner, it is possible to earn six data as a consequence of fee. But before we break apart the paycheck and pay structure, let us describe what a mortgage loan administrator are and you can broadly exactly what they are doing.

Due to the fact a mortgage manager, you’ll let your potential customers know if they be eligible for mortgage loans or home loans. Beyond the monetary element, there are also the new possibilities to incorporate customers that have information regarding different form of mortgage brokers readily available, in addition to rates of interest. Normally, real estate loan officials operate in banking companies and mortgage enterprises, providing guidance and you will guidance on home loans.

Home loan officers provides expertise in lending products. They also have a comprehensive experience in banking industry rules and statutes and documentation required for getting a mortgage.

Home mortgage manager income

Home mortgage officers are typically paid-in two ways-otherwise a mixture of the 2-which happen to be to your front side otherwise on the rear.

While you are a loan manager repaid on front side, you receive money from this new fees the clients pick, including to have running the home loan, otherwise known as closing costs. Your potential customers may either shell out this type of charge with your own money when they sign new documentation or need all of them for the home loan.

When you are that loan officer paid off on the rear, you earn something similar to percentage in the financial to own offering your house mortgage. Speaking of costs website subscribers do not discover. For many who inform your customers he could be taking a zero away-of-wallet mortgage otherwise a zero-commission financing, it fundamentally function you are earning profits but are recharging it on the rear.

Due to this shell out structure, it is difficult to help you pin down how much cash mortgage officers make in america. This new average mortgage loan officer paycheck is just over $66,000 annually, centered on data amassed of Beast.

A reduced-generating real estate loan officers, at the same time, average roughly $42,five-hundred a year as well as the high-making officers generate upwards of $89,000 a year. Your income often mostly depend on how many percentage-established money you need to use close. This will make you a heightened incentive to market yourself to prospects.

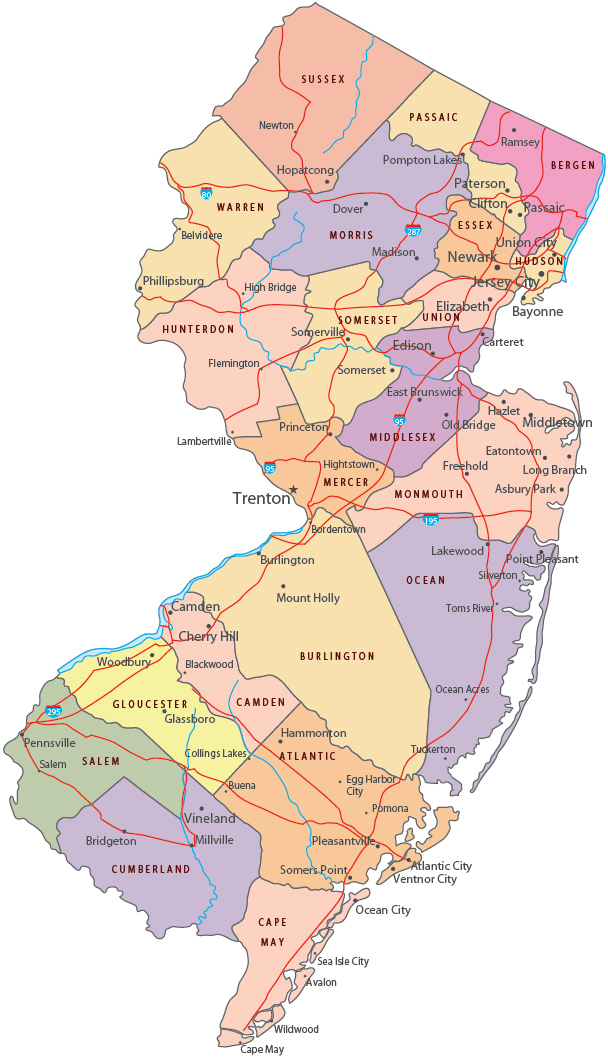

Mortgage loan administrator income: average by the condition

Is a report on the common annual income out-of a good mortgage administrator by the condition, predicated on analysis authored by ZipRecruiter.

What do the major mortgage officials generate?

https://paydayloanalabama.com/smoke-rise/

The big home loan officials in the usa generate $226,774 a-year, centered on study authored by Glassdoor.It contour has ft shell out and extra shell out.

Нет Ответов