More and more people look comfy credit money from its 401(k) and you can taking right out a great 401(k) mortgage . . . even though this means shedding at the rear of on the retirement savings.

During the 2020, regarding the one out of four people who have a manager-sponsored old-age package got an excellent 401(k) mortgage equilibrium, plus the average harmony of those 401(k) loans is actually $9,612. step 1

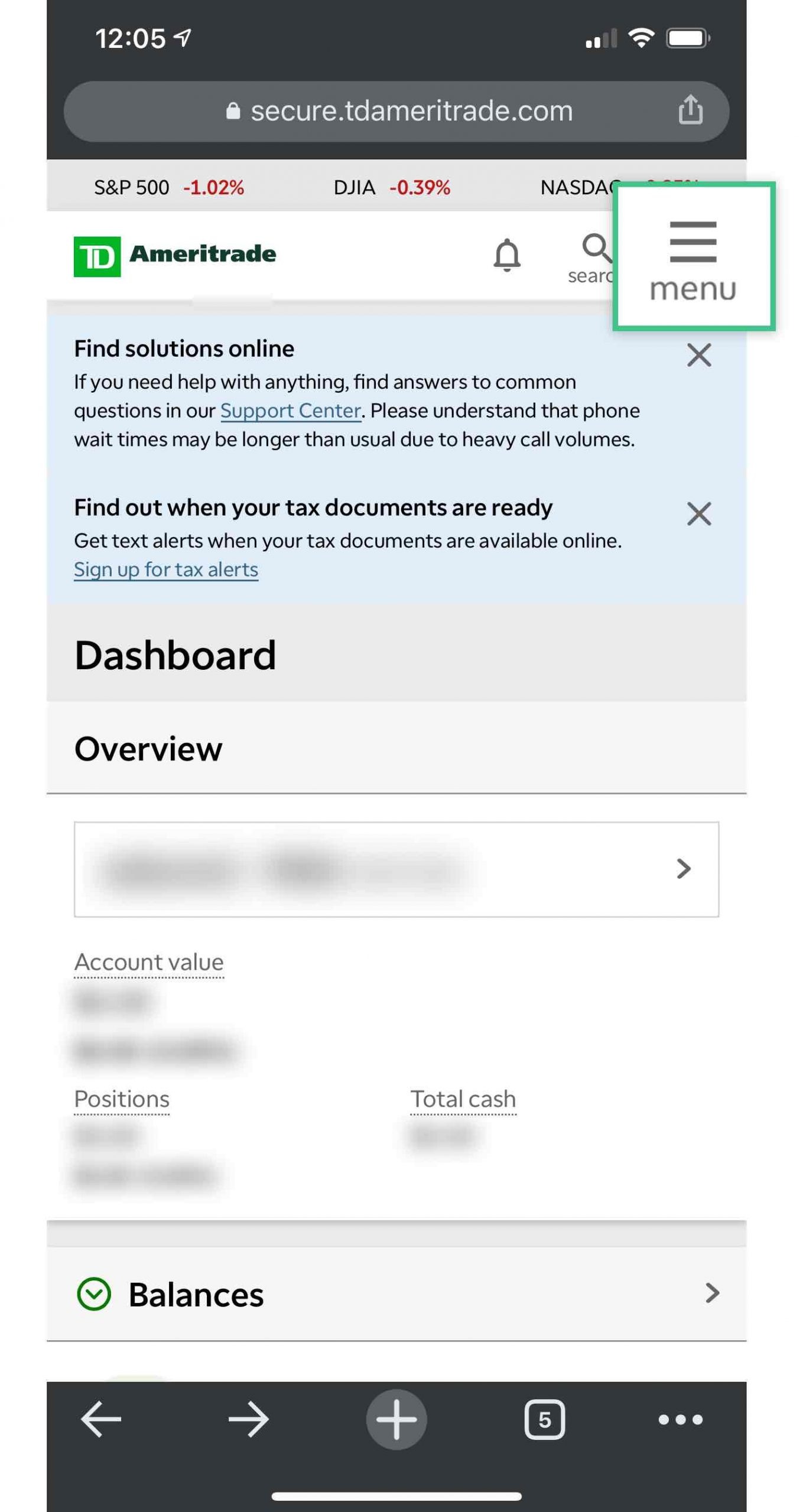

You are probably considering your retirement account’s equilibrium and you will curious if the a great 401(k) mortgage can help you safety the expense of that vehicles resolve otherwise kitchen area repair.

Listen, we are not browsing overcome within the bush: If you’re a 401(k) loan might seem to solve a number of their issues today, it creates a whole new number of circumstances tomorrow and you may age of the future . . . and it’s really not worth the headache.

Why don’t we plunge a little greater into exactly what a 401(k) loan is, the way it operates and just why it certainly is a terrible suggestion.

What exactly is good 401(k) Financing?

An effective 401(k) mortgage try an arrangement enabling you to definitely borrow money away from your employer-sponsored advancing years membership to the comprehending that you’ll need to get back those funds into the 401(k) throughout the years-and additionally interest.

Some people you will imagine taking out a good 401(k) loan as an option to trying to get an unsecured loan through a financial or any other bank otherwise away from taking out fully an early detachment http://www.paydayloancolorado.net/indian-hills (which may indicate taxation and fees).

As you will be technically credit your own currency, extremely 401(k) fund become approved quite without difficulty. There are no banks or lenders with it, therefore nobody is probably look at the credit rating otherwise borrowing from the bank records prior to enabling you to obtain from the 401(k). You’re the main one taking up all of the exposure (and we will go into those dangers for the the second).

Why does an excellent 401(k) Mortgage Works?

If you’d like to borrow funds from your own 401(k), you will need to sign up for an effective 401(k) loan through your plan mentor. Once your mortgage will get acknowledged, you’ll be able to signal financing agreement filled with the second:

- The primary (extent you borrowed from)

- The word of your own mortgage (how long it will require one pay the mortgage)

- The speed or other charge

- Every other conditions that may use

If you have a manager-sponsored retirement package-including good 401(k), 403(b) otherwise 457(b) plan-you might usually acquire up to 50% of account balance, but just about $50,000. dos

When you make an application for good 401(k) mortgage, you can determine how much time new loan’s label would-be, nonetheless it cannot be over five years-that is the longest fees period the federal government allows. However, do you really want to be indebted for 5 many years?

Extremely plans allow you to setup automatic payments through payroll write-offs, for example you’ll end up enjoying less of your budget on your own paycheck up to the loan was paid back. Those people costs-which include the primary therefore the notice-could keep supposed right into your 401(k) before principal try paid down. And continue maintaining in mind one certain organizations would not allows you to set any extra money into your 401(k) when you’re paying down the loan.

Ready for most bad news? Your loan payments could well be taxed maybe not immediately after, but twice. In place of traditional 401(k) benefits, being taxation-deferred, you will not rating a taxation split for the financing payments. Alternatively, those funds gets taxed earlier gets into your own 401(k) after which you’ll be able to shell out taxation again when you take the bucks in retirement.

Although really scary area regarding taking out an effective 401(k) loan is exactly what happens for individuals who eradicate your work. Because if you earn fired, let go or want to leave your task while however provides a loan harmony, you will need to pay back the complete equilibrium back to your own 401(k) by following year’s income tax filing deadline (aka Taxation Day). step 3 Into the existing days, you had just sixty in order to 90 days to repay the whole harmony, nevertheless the Tax Cuts and you may Jobs Act gave consumers a little additional time.

Нет Ответов