While the IBR preparations manage reducing your monthly premiums, it extend your own installment title. Rather than the basic a decade, you are paying down your figuratively speaking to own 20 to help you twenty five years.

This basically doubles your time in debt, and this isn’t good for group. The smaller your monthly premiums, the longer you’ll end up with debt.

The latest effects off more hours indebted are very important to look at. It could mean that you’ll be paying off your college student fund in the event your babies go to college. It might apply to your capability to shop for a house or vehicle. You’ll need to be ready to accept men and women outcomes.

While the you’ll be during the fees to possess a supplementary ten to fifteen ages, more student loan focus commonly usually make over the period.

You’ll be able to save money over the lifetime of the borrowed funds using this extra notice than simply you might have spent with a standard Installment Package.

nine. The bill away from a keen IBR education loan you are going to grow.

Thereupon increased focus and you will offered installment label, you’ll be able to that your particular loan’s leftover equilibrium you will expand in lieu of compress. High education loan balances can result in high month-to-month desire charges.

If you have a keen IBR bundle, your own monthly installments may well not protection that accrued notice, that’s described as negative amortization. With this particular income-driven bundle, the us government will pay most of the or a few of the notice that is not covered by your payment. This will merely last for as much as about three consecutive decades out of after you first started settling your own education loan underneath the IBR bundle.

After those individuals 36 months are up, otherwise keep qualifying for IBR or if you log off the latest plan, any outstanding interest could well be get a fast loan today placed into your debts and you may capitalized, fundamentally strengthening so much more student loan loans.

10. You have got to qualify for a keen IBR bundle.

To be eligible for an IBR plan, you ought to be in a position to have indicated limited pecuniary hardship. Their potential IBR monthly student loan payments never equivalent otherwise go beyond your instalments under the 10-season Basic Fees Bundle.

Keep in mind that your own partner’s money you can expect to disqualify your to own an IBR plan. Their payment per month depends on your combined earnings and you will loan loans.

- Direct Backed and you may Unsubsidized Money

- Direct Scholar And Finance

- FFEL Integration Loans

- Lead Combination Funds

Whoever has taken out Mother or father In addition to loans or any other particular federal loan built to parents usually do not qualify for IBR. However Mother Together with finance is consolidated, they could be believed getting an enthusiastic ICR package.

11. There was files that you must over to get and maintain an IBR plan.

To try to get a keen IBR plan, you’re going to have to submit a keen IBR demand mode on the web or if you can be fill in a newsprint function from the financing servicer.

IBR plans also require your own payment per month is recalculated all of the seasons. Therefore most of the 12 months, you will need to make sure to recertify your revenue so you can keep IBR package. This can alter your payment based on their updated nonexempt money.

If you do not recertify your earnings on time, your own IBR plan could be canceled. Your own student loans will likely then revert towards the Standard Repayment Package.

Are Earnings-Established Repayment sensible to you personally?

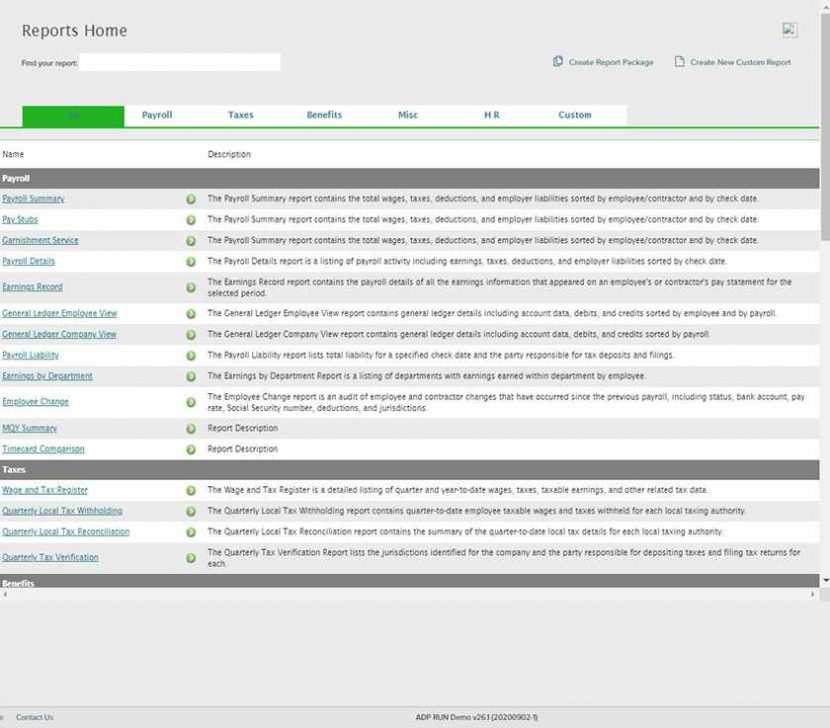

To see if an enthusiastic IBR bundle is the best for you and the college loans, you will need to make a good usage of an income-Built Cost calculator, for instance the MoneySolver IBR calculator. You can access so it unit because of the pressing the picture lower than.

This money-mainly based installment student loan calculator can show your their possible monthly fee count. Additionally, it may show you the new fees term and possible to own forgiveness. Whenever you are straight down monthly installments voice high, you ought to make sure an enthusiastic IBR plan is the better choice to you personally along with your monetary future.

Нет Ответов